During the Great Recession, Arizona shifted from a K-12 funding system primarily supported by the state, to one where local taxpayers provided a larger share of those revenues. The fact that the amounts from all of these local sources vary by school district, sometimes quite significantly, and that charter schools do not have access to many of these sources, makes bonds and overrides problematic for many education stakeholders. This blog post will address bonds and overrides and provide context on the inequities for students as reliance on local funding has increased.

Bonds and overrides are only two of the multiple sources of revenue that fall under the “local” category of school revenue sources. Others include: the local portion of the state equalization formula, small isolated district funding, desegregation funding, adjacent ways, public school tax credits, and any other money raised locally by the district through donations or fees. Bonds and overrides make up the biggest share of these, second only to the local portion of the equalization formula.

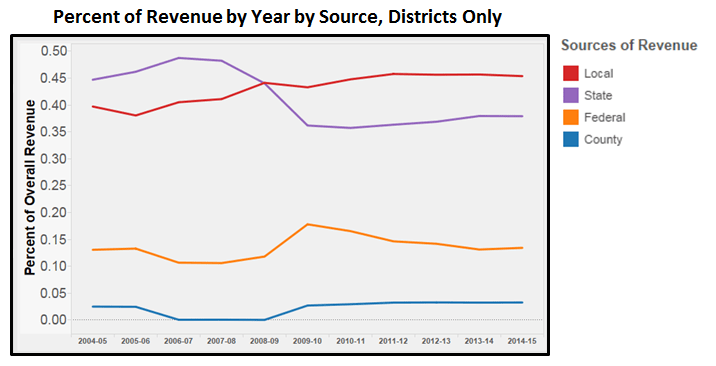

The Arizona Department of Education released in January the Annual Report of the Arizona Superintendent of Public Instruction, Fiscal Year 2015[1]. Page six of Volume I offers a ten-year breakout of the sources of revenue for education; below is a graphical representation of that same information (“county” and “intermediate” source categories have been combined for presentation).

The fact that the amounts from all of these local sources vary by school district, sometimes quite significantly, and that charter schools do not have access to many of these sources, makes bonds and overrides problematic for many education stakeholders. The state has come to rely more heavily on the local school districts to fund a portion of our public education system which poses a challenge to “fixing” the inequalities local funding sources create between communities.

The above graph shows clearly that the 2008-2009 fiscal year represented a shift from a funding system where the state provided the largest share of revenues for districts to one where local taxpayers provided the larger share of those revenues. This was likely precipitated by the Great Recession and the state’s budget shortfalls to follow, but while both the federal and county shares have returned to pre-recession levels, the state/local shift has remained in place.

Bonds

Starting in 1980 and prior to the Students FIRST Act of 1998, schools relied on “Class A” bonds to fund large capital projects such as the construction of new buildings, or the purchasing of school buses or furniture. Class A bonds required voter approval, because they were accompanied by an increase in property taxes. School districts could ask voters within their district for permission to sell bonds up to a maximum of 15% of the district’s secondary assessed value , and unified school districts could ask for a maximum of 30% of the secondary assessed value[2].

When the Arizona Supreme Court deemed this practice unconstitutional in the 1994 ruling Roosevelt v. Bishop, on the basis that it allowed “property rich” districts to tax at higher rates to produce more financing dollars than their “property poor” counterparts, change was afoot. Lawmakers proposed two possible systems, which were both rejected by the Court, before the Legislature successfully enacted the Court-approved Students FIRST Act of 1998.

Among other things, Students FIRST changed the way that school bonds worked in Arizona. As of December 31, 1998, all future voter-approved bonds were to be known as “Class B” bonds, and carried with them the following restrictions:

- New, lower, debt limits of 5% of secondary assessed value for school districts and 10% for unified school districts (down from 15% and 30%, respectively)

- Bond Elections required to be held during a November general election

- Bonds may not be used to finance “soft capital,” or short-term capital investments such as textbooks (a ban which was permanently lifted in 2009[3])

The legislation also established the School Facilities Board (SFB), which was charged with setting facilities standards for all schools, and overseeing the funds that were distributed to schools to meet these standards. The SFB was (and is) funded by the state General Fund, and the influx of state dollars into district schools’ capital outlay finance equation was the justification for the newly-lowered local debt limits.

The debt limits remained at 5% for elementary and high school districts and 10% for unified districts until 2013, when the limits were raised to 10% and 20%, respectively[4]. Today, school districts are still subject to the 10%/20% debt maximums when considering whether or not to ask voters for bond approval. Bonds may be issued any time within 10 years of voter approval[5].

Overrides

A second form of voter-approved funding comes in what are called overrides. Much like bonds, overrides are financed by a raise in local property taxes, and are also used to fund special purchases and programs that schools would like to implement, but that are not covered by the state-provided budget. Most overrides expire after seven years, with the first five years consisting of full budget override funding, and the final two years acting as “phase out” years. Many school districts return to the voters in year 5 of an override to ask for a renewal, thereby eliminating the phase-out years, to keep funding at full budget levels.

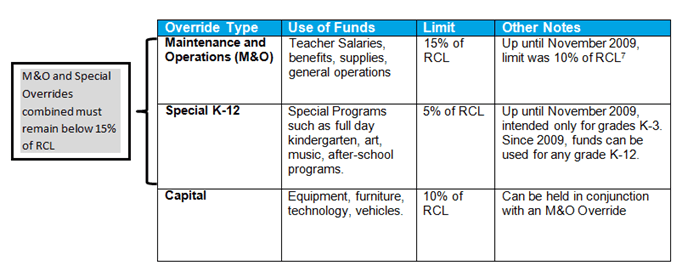

There are three types of overrides: Maintenance and Operations (M&O), Special, and Capital.

- M&O Override: used to pay for general operations in a school – most commonly used for human capital expenses. This can cover teacher salaries, benefits, newly hired positions, or other everyday purchases such as supplies.

- Special Overrides: originally created to only fund K-3 special programs, such as full-day kindergarten, after school activities, or special education support. However, in 2009, the K-3 restriction was lifted, and schools are now able to fund any K-12 program with the funds from a special override[6].

- Capital override: much like bonds, used to fund capital purchases such as textbooks, technology, furniture, or student buses.

All three types of overrides come with their own sets of restrictions – the limit, which is calculated as a percentage of a school’s revenue control limit (RCL), what the money can be spent on, etc. A district may have all three overrides at one time, though many districts choose to lump the Special Override in with the M&O override, since they cannot exceed 15% combined.

The following table summarizes these attributes:

Conclusion

Footnotes/References

[1] http://www.azed.gov/finance/reports/#SafrTop

[2] Arizona Revised Statute, §15-1021(A)(C)

[3] Laws 2009, 3rd S.S., Ch. 12, §38

[4] Laws 2013, 1st S.S., Ch. 3, §35.

[5] Arizona Revised Statute, §15-1021(E)

[6] Laws 2009, 3rd S.S., Ch. 12, §§ 11-12

[7] Laws 2009, 3rd S.S., Ch. 12, §§ 11-12