The Arizona Legislature recently ended its 2015 session and one of the more significant pieces of education policy to emerge from it is the recognition of charter school “networks,” or groups of affiliated charter school organizations. In short, the Legislature has determined that charter schools that are part of a network should be treated as one organization, rather than individual entities, for the purpose of state funding. The result is that these charter school networks are funded similarly as traditional school districts.

Since 1994, Arizona has treated charter schools as independent entities, even if they are part of a larger group of charter schools. As a result, little information exists about the number of charter “networks” that exist or how large they are. The Association has combined information from the Arizona Department of Education with charter school affiliations collected by the Arizona Charter Schools Association to begin to fill the information gap.

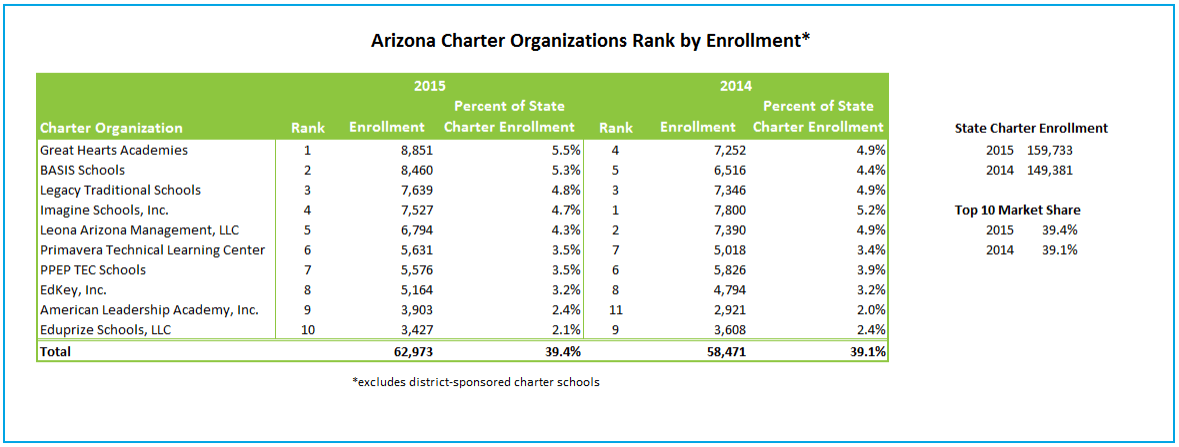

Taking this new view of charter schools, Arizona has 267 unique charter organizations, where some are networks of affiliated schools and others are a single school campus operating independent of any other school or charter organization. Combined, all charter organizations in the state enrolled nearly 150,000 students in 2014 and nearly 160,000 students in 2015, excluding district-sponsored charter schools.

Table 1 shows that in the last two years, the ten largest charter organizations — networks and single charter organizations — enrolled nearly 40 percent of all charter students. In 2015, the two largest organizations enrolled nearly 11 percent of charter students.

The table also shows the relative ranking of charter organizations based on their share of charter student enrollment. Nine out of ten charter organizations appear on both lists; however there is movement in the rankings. For example, Great Hearts Academies rose from fourth to first, while Imagine Schools dropped from first to fourth. These data demonstrate that eight out of the ten schools relative rankings shifted from 2014 to 2015, all but Legacy Traditional Schools and EdKey, Inc. This suggests that while there is a concentration of charter enrollment in the state’s largest charter organizations, enrollment patterns within this group varies.

It is unclear from these data the reasons why these networks are successful in enrolling a large proportion of the state’s charter students. However, these data provide an opportunity to ask questions about the types of schools parents are choosing to enroll their children. These charter organizations represent a variety of instructional models from back to basics to online, indicating that a large number of families are making enrollment choices across instructional methods. Additionally, the top three networks in the 2015 rankings represent schools that focus on academic rigor and college and career readiness through their unique instructional methods. Whereas, in the 2014 rankings, one of the top three networks, Leona Arizona Management, LLC, has diverse curriculum at its schools, including several that focus on students who have been unsuccessful in traditional settings.

These data also present additional policy and research questions for the future. How are the innovation, flexibility, and freedom from bureaucracy at the heart of the charter movement kept alive in these large charter organizations? If enrollment continues to concentrate in larger charter organizations, what is the future of the small, independent charter school? And most importantly, what does all this mean for students?